There are also hedge funds that are always seeking to improve their bottom line. As long as the trend and technicals look good, they will continue to invest and trade in the yellow metal.

Gold is also coveted by several countries like Vietnam and India as it is often given as a gift at weddings (Dowry)

Fiat currency will continue to lose it's value as more is printed. Theoretically, this will increase the price of Gold and Silver.

Institutions and funds that are short the metal will be forced to 'buy back' and cover their positions.

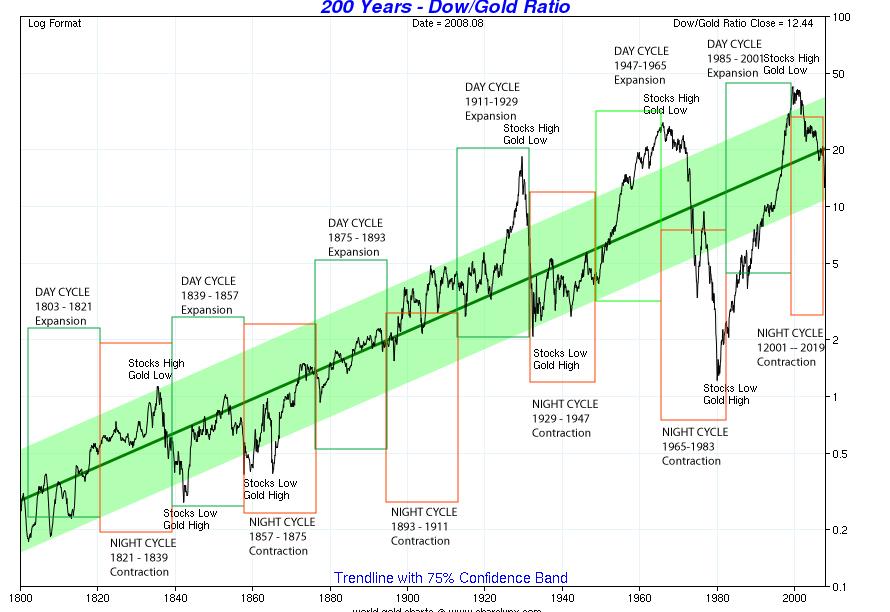

So is Gold going to continue to appreciate in the years go come? Will it become the best investment over the last 100 years and continue its upwards run going forward? I say no and that a lot of people that have not followed the Gold market will eventually hear that it has been a solid investment over the past 8, 9, 10+ years. When the rest of world/public start piling into the Gold and Silver markets, it will really take off as the market is not that large. Look at the chart above specifically at the 1980 area. This is the last stage of a Gold bull market, the mania phase where everyone wants in pushing the price up. (Everyone is after 'easy' money right?) After it peaks, what happens? The bubble pops and someone is going to be left holding the bag. I can guarantee you that the hedge funds, Goldman Sachs, JP Morgan, HSBC and other major financial institutions and high end investors (John Paulson) will be out before it pops.

So will there be a Gold bubble? I say yes and in general, most people don't spot a bubble before they form and burst. (You don't see a bubble when your in one) If I had to guess, I'd say that we are heading into the 3rd stage of 3 in the Gold commodity bull run. So how will you know when to get out? That is the $100,000,000 question.

The bottom line is that it is up to you when you want to get out, that is if you want to get out. Some people will always want to hold onto their physical Gold and that's OK as Gold will ALWAYS have value. Just keep your eye on the Dow/Gold ratio. In 1980, it was very close to 1:1 at the top.

Buy gold safely Click Here!

Buy gold safely Click Here!